Complete Business coaching series by Mr. Puneet Mathur

Funding:

‘Funding’ refers to the money required to start and run a business. It is a financial investment in a company for product development, manufacturing, expansion, sales and marketing, office spaces, and inventory. Many startups choose to not raise funding from third parties and are funded by their founders only. This is because the startup owner would like to prevent debts and dilution of equity. However, most startups do raise funding, especially as they grow larger and scale their operations.

This article is for entrepreneurs who would like to understand why funding is needed, types of funding available, and how to raise funding.

Why is Funding required?

A startup might require funding for one, a few, or all of the following purposes. It is important that every entrepreneur is clear about why they are raising funds. Further, a detailed financial and business plan is necessary before entrepreneurs approach investors for funding.

• Prototype creation, product development, website/app development

• Manpower hiring

• Manufacturing equipment

• Raw materials

• Working capital

• Marketing and Sales

• Office space and other admin expenses

• Legal and consulting services for your startup

• Licenses and certifications

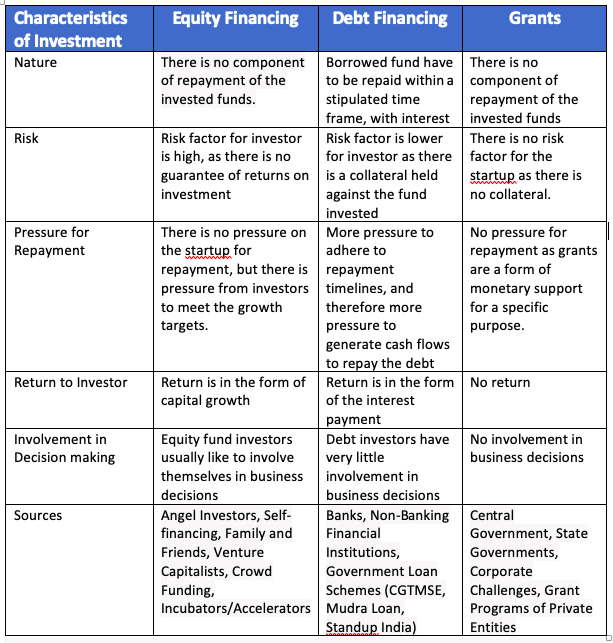

Types of Funding:

Stages of Startup and Sources of Funding:

There are multiple sources of funding available for startups. However, the source of funding should typically match the stage of operations of the startup.

It is important to understand that raising funds from external sources is a time-consuming process and can easily take over 6 months to convert.

Ideation/Pre-Seed Stage

This the stage where the entrepreneur has a business idea and is working on bringing it to reality. At this stage, the amount of funds needed is usually small.

The sources of funds utilized by startups in this stage are:

1. Bootstrapping/Self-financing: Bootstrapping a startup means starting your business with little or no outside investment. The entrepreneurs rely on their own savings and revenue to operate and expand. This is the first recourse for most entrepreneurs as there is no pressure to pay back the funds or dilute control of the startup.

2. Friends and Family: This is also a commonly utilized channel of funding by entrepreneurs still in the early stages. The major benefit of this source of investment is that there is an inherent level of trust between the entrepreneurs and the investors

3. Business Plan/Pitching Events: This is where the funds are made available in the form of prize money/grants/financial benefits, provided by institutes or organizations that conduct business plan competitions etc.

Even though the quantum of money is not generally large, it is usually enough at idea stage. What makes the difference at these events is having a good business plan.

Know more at https://www.startupindia.gov.in

Validation/Seed Stage

This is the stage where your startup has a prototype ready and the potential demand for the product or service needs to be validated. This is called conducting a ‘Proof of Concept (PoC)’, after which comes the big market launch. To do this, the startup will need to conduct field trials, test the product on a few potential customers, get mentors on board, and build a formal team. Common funding sources utilized by startups in this stage are:

• Incubators: Incubators are organizations set-up with the specific goal of assisting entrepreneurs with building and launching their startups. Incubators offer a lot of value-added services (office space, utilities, admin & legal assistance, etc.) and more importantly, they often make grants/debt/equity investments.

• Government Loan Schemes: The government has initiated a few loan schemes to provide collateral-free debt to aspiring entrepreneurs and help them gain access to low-cost capital. Some such schemes include

- CGTMSE

- MUDRA, and

- Stand-up India.

• Angel Investors: Angel investors are individuals who invest their money into high potential startups in return for equity. Some known Angel Investors in India are:

- Indian Angel Network

- Mumbai Angels

- Lead Angels

- Chennai Angels

- Relevant industrialists

• Crowd funding: Crowdfunding means reaching out to the general population and raising money. (Each individual contributes a relatively small amount but the sum total can be substantial). This is typically done via online crowdfunding platforms.

Early Traction/Series A Stage

This is the stage where your startup’ s products or services have been launched in the market and Funds are now required to further grow user base, launch additional products, expand to new geographies, etc. Key performance indicators such as market share, revenue, app downloads (in case where the business is based on a mobile app), etc. become important at this stage. Common funding sources utilized by startups in this stage are:

• Venture Capital Funds: Venture capital (VC) funds are professionally managed investment funds that invest exclusively in high-growth startups. Each Venture Capital Fund has its own investment specialization – preferred sectors, stage of startup, and funding amount. VCs take startup equity in return for their investments and actively engage in mentorship of their investee startups.

• Banks/NBFCs: Formal debt can be raised from banks and NBFCs (Non Banking Financial Institutions) at this stage. The startup can showcase its market performance and revenue growth trends to validate their ability to finance interest payment obligations. This is especially applicable for working capital. Some entrepreneurs might prefer debt over equity as they debt funding does not dilute equity stake

• Venture Debt Funds: Venture Debt funds are private investment funds that invest money in startups primarily in the form of debt. Debt funds typically invest along with an angel or VC round.

• TReDs: To decrease the financing concerns faced by MSMEs in India, RBI introduced the concept of TReDS in 2014, an institutional mechanism for financing trade receivables on a secure digital platform. Trade Receivable Exchanges such as M1xchange, standardizes the process of funding MSMEs via Invoice Discounting. TReDS is an initiative to help Medium and Small manufacturing enterprises overcome the challenge of delayed payments from customers which lead to working capital shortages. TReDS is a timely and effective solution to drive the MSME sector to the next phase of Indian economy.

Scaling/Series B & Above Stage

At this stage, the startup is experiencing fast rate of market growth and increasing revenues. Common funding sources utilized by startups in this stage are:

• Venture Capital Funds: VC funds with larger ticket size in their investment thesis provide funding for late stage startups. It is recommended to approach these funds only after the startup has generated significant market traction. A pool of VCs may come together and fund a startup as well.

• Private Equity/Investment Firms: Although Private equity/Investment firms generally do not fund startups, some private equity and investment firms have, of late, been providing funds for fast-growing late-stage startups who have maintained a consistent growth record.

Initial Public Offering

Initial Public Offer (IPO) refers to the event where a startup lists on stock market for the first time. Since the public listing process is elaborate and involves a lot of statutory formalities, it is generally undertaken by startups with an impressive track record of profits and who are growing at a steady pace. One of the benefits of an IPO is that a public listing at times can increase the credibility of the startup and be a good exit opportunity for stakeholders.

Any Angel investor, Venture Capital, or Private Equity fund may buy out investors of a previous round to get their equity share as well. Also, there are various State Policies which help the startups in various phases of funding or give them incentives and allowances to help them grow such as:

• Karnataka: Government of Karnataka provides seed funding under the ‘Idea2PoC’ scheme of Startup Policy of Karnataka 2015-20. Idea2POC is given in the form of Grant-in-aid but limited to a one-time grant of up to INR 50 lakhs. Aspiring entrepreneurs can apply for the scheme incentive during call for proposal through an online portal. The website also mentions the required eligibility criteria.

• Gujarat: State Government provides seed funding to startups in the form of Sustenance Allowance, Product Development Assistance and Marketing Assistance. An amount of INR 10 Lacs is provided as seed funding.

• Jammu and Kashmir: Government of J&K has launched Seed Capital Fund Scheme under which Seed Money up to maximum INR 10 Lacs the project cost is provided to eligible prospective entrepreneurs to kick-start their ventures.

• Rajasthan: Government of Rajasthan provides seed funding in form of monthly sustenance allowance under the ‘Assistance for Startup at Idea or prototype stage’ of Rajasthan Startup Policy 2015. All eligible startups can apply for seed funding through their iStart Startup dashboard.

Additional resources for startup funding are available at https://cleartax.in/s/startup-funding-options-indi

Puneet Mathur is a Certified Life Coach, Certified Business Coach and a Certified Organization Development Coach. Puneet is an experienced business leader, with about 30 years of Corporate Leadership experience in reputed Multi National and Indian Companies in the FMCG and Chemicals sector. Email: pmathur@principiumadvisory.in mail@puneetmathur.in Websites: www.principiumadvisory.in www.puneetmathur.in